Section 125 Flexible Savings Account

Below are links/descriptions to all the benefits and related programs for DPI employees. If you have additional questions, please contact Heather Muldoon, Benefits Manager (hmuldoon@thedpigroup.com).

Flexible Spending Accounts (FSAs) provide you with an important tax advantage that can help you pay health care and dependent care expenses on a pre-tax basis. By anticipating your family’s health care and dependent care costs for the next plan year, you can actually lower your taxable income. The Internal Revenue Service allows FSAs as a means to provide a tax break to employees and their dependents. As an employee, you agree to set aside a portion of your pre-tax salary in an account, and that money is deducted from your paycheck over the course of the year. The amount you contribute to the FSA is not subject to Social Security (FICA), federal, state, or local income taxes - effectively adjusting your annual taxable salary. The taxes you pay each paycheck and collectively each plan year can be reduced significantly, depending on your tax bracket.

Use it or lose it: Unlike an HSA, an FSA is subject to the IRS “use-it or lose-it” rule. This means any amount remaining in your account after the plan year ends cannot be returned to you. Please estimate your qualifying expenses carefully each year. You must actively re-enroll each year; re-enrollment is not automatic.

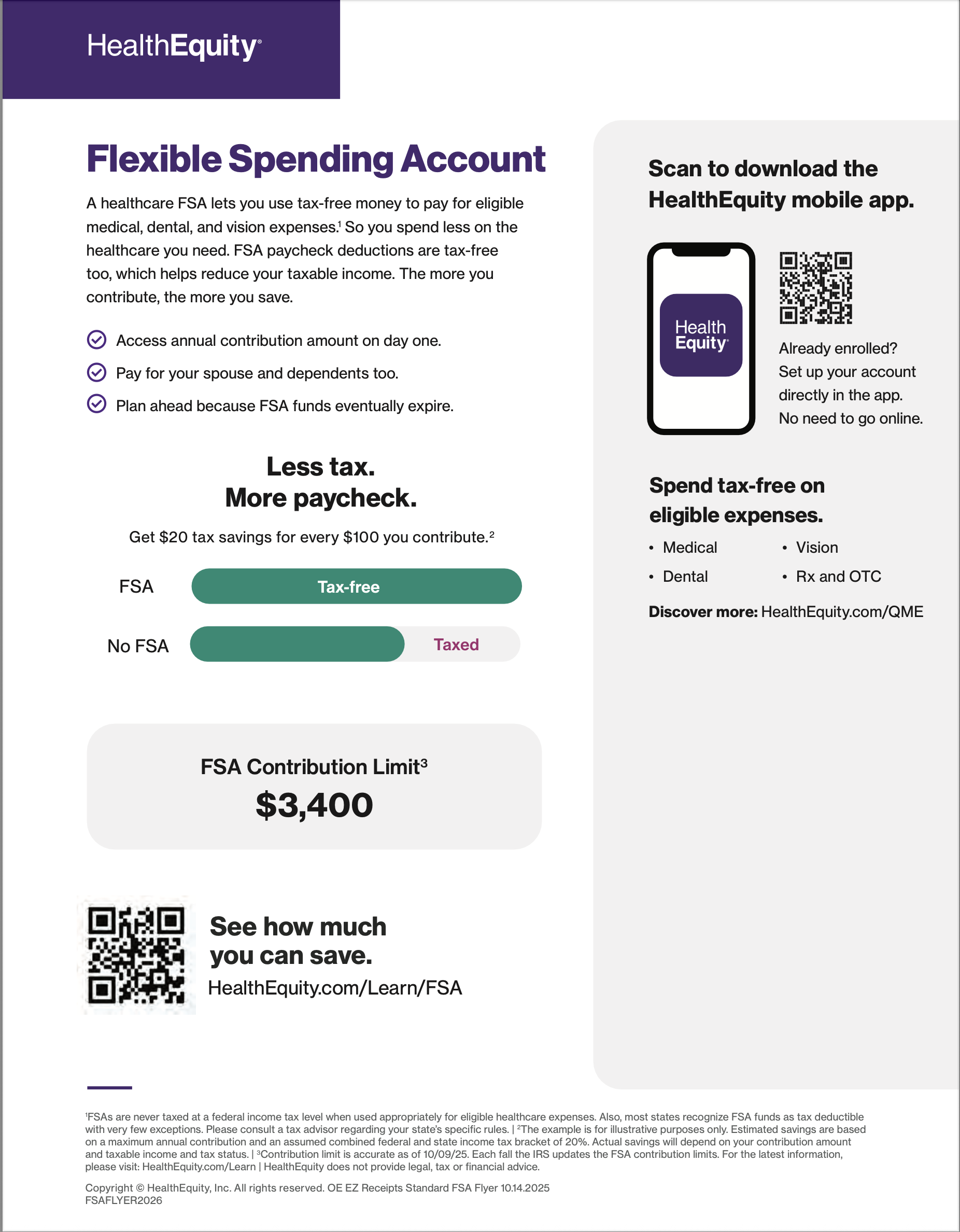

Healthcare FSA: Our Healthcare FSA is a way for you to pay on a pre-tax basis certain tax qualified health expenses for you and your eligible dependents when they are not covered by health benefit plans. It is important that you carefully and conservatively determine how much to annually contribute to your FSA because you cannot be reimbursed for funds remaining at the end of the plan year and you cannot change your annual contribution amount except for certain changes in your family status. If your employment is terminated, your flexible spending eligibility ends on the date of termination, and you have 30 days from date of termination to request reimbursement for claims. The maximum Healthcare FSA contribution you can make is $3,400 annually.

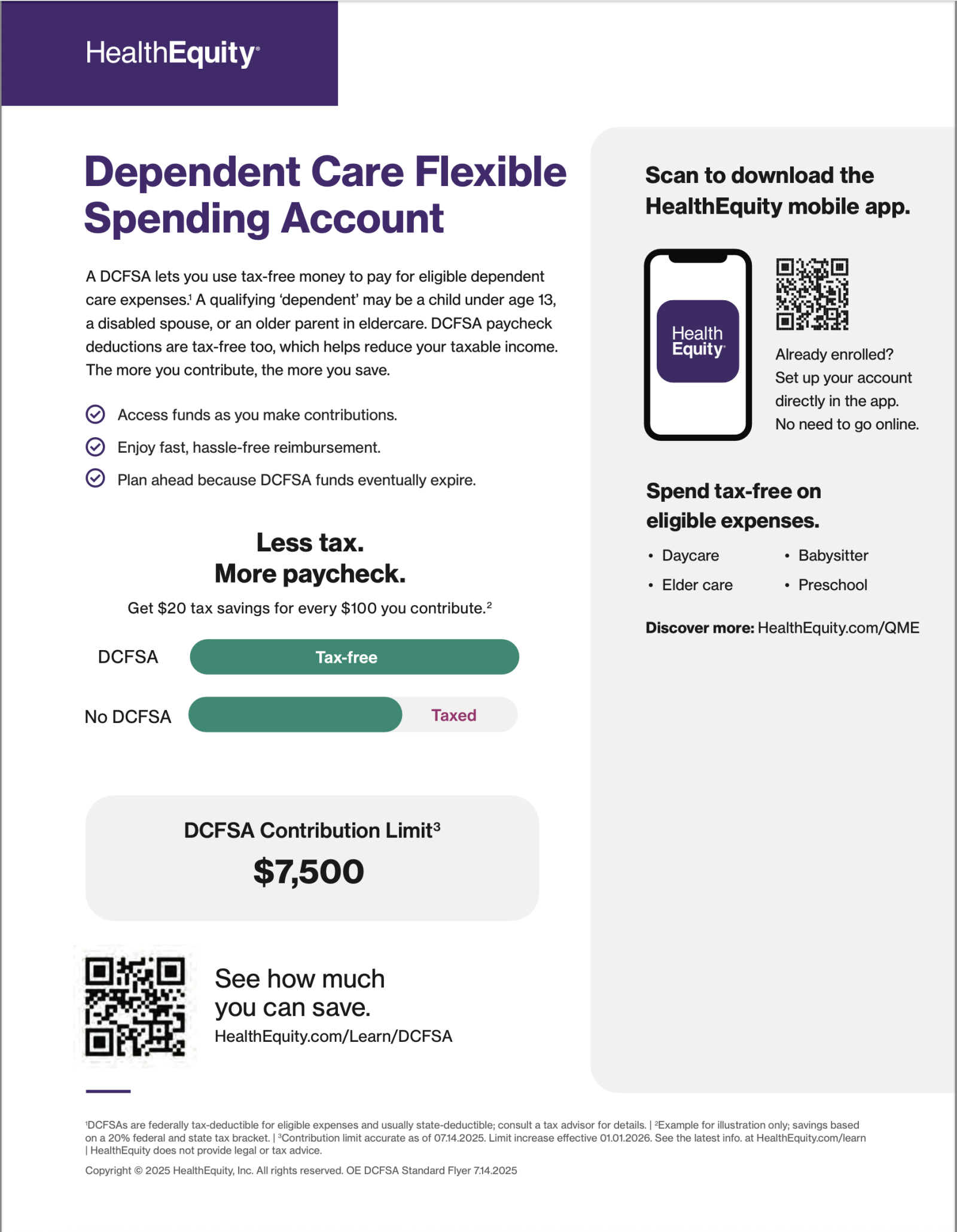

Dependent Care FSA: This plan allows you to set aside a portion of your salary on a pre-tax basis to pay for dependent care expenses. In order to qualify as expenses under the plan, the dependent care must be necessary to enable you and your spouse to work (student and spouse disability status may also qualify under the plan as “work”). The maximum salary reduction allowed by the plan is $7,500 if you file a joint tax return, or $ 3,750 in the case of a married individual filing a separate income tax return.

Premium Only Plan: If you are enrolled in the Health Plan through The DPI Group, your health plan premium contributions will be deducted on a pre-tax basis, thus reducing your withholding taxes. This means that your premiums are deducted from your salary before taxes, which reduces your taxable income. Please note that this program does not apply to health coverage obtained outside The DPI Group. This benefit only applies if you are enrolled in Health Benefits through The DPI Group. No separate enrollment is required.